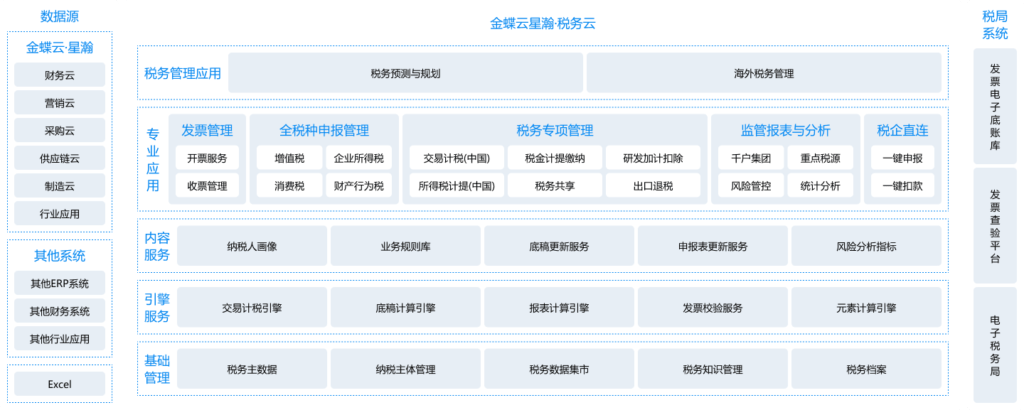

Proprietary “software + service” concept designed to support enterprises in developing a highly precise digitized controller system that meets the regulatory compliance, covering full-range tax management services by integrating the ledger records of business activities, finance, tax, invoices, data and documentation.

By addressing multiple common pain points of corporates: difficulties in collecting tax-related data, complicated tax returns filing process, lack of control over tax risk monitoring and management, lack of data transparency, and lack of an efficient tax analysis model or suitable tools, Kingdee Cloud Constellation Tax Cloud Service optimizes the overall productivity and efficiency of the tax team, while supporting enterprises in meeting the regulatory compliance.

Pre-configured filing engine provides content management and maintenance services, supporting over 5,000 tax scenarios applicable to over 2,000 corporate types. Over 100 tax filing formats are automated and available for use.

Activate Enterprise Tax Connect, the direct tax panel, for one-click declaration, one-click payment, easy management of tax certifications and monitoring of tax declaration tasks. Get an instant overview of the corporate tax status, eliminating potential late filing or omission.

Tax work is divided into measurable tasks, while documents and tax filing are centralized for standardized management. Combined with tax knowledge management, tax file archiving and other functions, the tax management process becomes further streamlined, improving the overall quality and efficiency.

Invoice verification, automatic account reconciliation, built-in tri-gold verification in the declaration form, combined with risk alert and contingency features, allow a comprehensive risk monitoring and management system throughout the entire billing process, blind spot-free.

Kingdee Cloud Constellation Tax Cloud Service provides enterprises with access to real-time tax-related data, pre-set risk management model, integrated records of business activities, finance, tax, invoices, data and documentation.. As a result, tax return filing status is instantly updated and synchronized, ensuring a seamless, precise, automated and effortless tax return filing process.

與SRM系統和應付等業務系統的採購訂單與發票數據、發票物流等對接,三單自動校驗自動匹配,自動生成應付單據與憑證,推動應付管理審核流程自動化

自動快捷匹配發票抬頭和稅收分類編碼,業務—收銀系統在消費小票上追打開票二維碼,實現消費者自助掃碼開票

可根據財稅數據、稅率變動,預測整體稅金、稅負。為企業提供一個易用、高效、安全的進項發票管理平台。提供銷項發票台賬報表、銷項分類統計表、銷項分類匯總表、空白髮票餘額表、開票項目異常預警表等報表。用戶可依據所需數據,輸入條件篩選發票數據。支持輕分析,可以實現內嵌的BI分析服務

提供全稅種全量申報項及取數維護,包括收入、稅會差異調整項、稅收優惠等,支持集團共享管控模式,幫助集團企業統一內部稅務遵從,全面降低稅務風險

依據企業涉及的申報項及涉稅數據,自適配最新的稅務政策及計算邏輯,自動出俱全稅種計稅底稿,計算當期稅費,底稿數據支持溯源查詢。全面提升企業稅務管理自動化水平,大幅提升工作效率,減少因人為失誤引發的稅務風險

支持歷史申報數據全量稅務資料追溯聯查,包括納稅身份和資質信息、全量申報數據、取數規則、計稅底稿和申報表等,使申報數據有源可尋,幫助企業降低人員流動銜接不當帶來的稅務風險

實現完稅憑證、正式申報表、申報記錄、繳款記錄等報稅憑證的附件管理,滿足審計和稅務檢查憑證需求

支持一鍵下載稅局各式報稅憑證

支持上傳附件,留檔備查

全方位監控和跟踪一鍵申報和繳款

支持查看報稅任務進度

支持查看報稅結果的日誌詳情

稅務工作按照複雜度進行分層管理,由不同角色負責不同納稅主體、不同稅種的申報,進行標準化流程化的作業,用戶登錄到稅務工作台, 只看與自己工作相關的信息,減少干擾,提升效率,防止錯報漏報風險

個性化配置任務卡片:“統一界面”過渡到“個性化工作台”

信息共享:“分散”過渡到“集中”

業務管理:“粗放”過渡到“精細”

依托底層數據中心,內嵌多維分析引擎,深度提取稅金數據,利用個性化圖表展示結果,快速掌握稅金動態

管理區域分析+行業分析+業務板塊分析

可視化圖表覆蓋地區分佈、稅種分佈、趨勢分析等

多維度之間相互關聯,稅務問題即刻發現

全面洞悉集團稅金情況,從全局出發,層層穿透,溯源分析,有效監控集團稅務運行情況

稅金地圖,輕鬆掌握稅金分佈

集團多角度稅金分析,助力敏捷戰略決策

靈活切換,涉稅問題即刻洞察

支持歷史申報數據全量稅務資料追溯聯查,包括納稅身份和資質信息、全量申報數據、取數規則、計稅底稿和申報表等,使申報數據有源可尋,幫助企業降低人員流動銜接不當帶來的稅務風險

幫助企業對關鍵指標進行監測,當指標出現異常情況時可以及時預警發現風險,並且能夠找到產生異常的源頭關鍵指標進行監測,當指標出現異常情況時可以及時預警發現風險,並且能夠找到產生異常的源頭

自定義關鍵風險指標

指標結果可視化展示

指標趨勢一目了然,助力風險分析

幫助企業對關鍵業務數據進行內部抽檢自查,及時發現問題數據源

自定義抽檢範圍及抽檢條件

抽檢問題數據可視化集中展示

幫助企業對關鍵數據進行核對,當有不一致情況出現時能夠及時預警,實現表內核對、表間核對

自定義核對項目

核對結果可視化展示

支持納稅信用等級查詢,提供一鍵查詢降級情況、可視化看板等功能,幫助企業發現信用危機,並進行提前部署以規避相關稅務風險

集團信用等級輕鬆查詢

一鍵查詢降級組織

“Digi-taxation” refers to the transformed smart model for managing tax in the current era of digitized economy.In March 2021, the State Council published “the Opinions on Further Deepening the Reform of Tax Collection and Administration”, in which a transformation from “paper taxation” to “digi-taxation” was proposed.From the tax industry’s perspective, this transformational upgrade has a direct impact on taxpayers’ capacity of managing taxation. When data transparency is only one-way and not cross checked, data discrepancy or inconsistency may result in legal liabilities and negative consequences.Therefore, a quality enterprise solution for tax transformation is a must!

In the past, corporates often started reviewing, organizing invoices, and filing for tax returns only after business activities and payments were complete. This traditional model resulted in overwhelmingly heavy workload closer to the end of each month, and challenges in monitoring and managing the risks incurred from paper tax management method. Business development of enterprises were often hindered as a result.In recent years, the tax system has been gradually reformed. Following OCR identification technology, direct interfaces between enterprises and tax bureau, or that between enterprises and banks, have been made possible. The increasing popularity of e-documentation has also made billing data collection, tax data, data of business activities, financial data, data of account payable and receivable, audit and documentation more accessible. Kingdee Cloud Constellation has created the inter-connection between various parties, including the tax bureau and banks, enabling online ledger verification. Numerous corporate groups have successfully achieved ledger record integration of business activities, finance, tax, invoices, data and documentation, supported by Kingdee Cloud Constellation.

One of the advantages of consulting firms is their standardized methodology to support enterprises in facilitating their digital transformation through a certain formulated route. However, enterprises, especially large-scale enterprises, all have their own unique management culture. Changing any procedures within a large enterprise can be very challenging. Whether or not the solutions proposed by the consulting firms can be actualized is often uncertain.Kingdee Cloud Constellation, however, provides consulting sessions and thorough assessment for a detailed digitization plan.It also enables invoice and VAT management, ledger record integration of business activities, finance and tax, offering full range of tax services, including tax return filing and management services, risk management, and tax savings, allowing enterprises to complete the digitization process seamlessly, steadily, and smoothly in phases.

Internal control and risk control run through the whole process of business management, and require a complete control system, including: how to avoid risks before the event, how to manage and control risks during the event, and how to tackle risks after the event. All should be done before the system is installed, even if the system is not perfect yet. The experience and pain points can be used for a better system infrastructure, reducing unnecessary extra efforts. A purpose-built system will help get twice the result with only half the effort.Even if you did not assess and manage the risk, and have not been clear about the possible outcome, you can always revisit the assessment during or even after the actual system infrastructure. By doing so, the system can then be built with more agility and higher adaptability. Kingdee Constellation Tax Cloud Service is designed for corporate management needs. Through EBC, known as the compatibility with further extensions, some basic functions can be set up in the initial phase, such as invoicing, tax calculation and tax return filing. Adding risk monitoring and management over time based on actual needs can be included in the later phase of the transformation plan.

If you have any questions, please call us at (852) 2157 9390. Our consultant will give you the best solutions for Digital Transformation.

Kingdee’s Product

©2023 Kingdee International Software Group (HK) Ltd. All rights reserved.